Renters Insurance in and around Chicago

Looking for renters insurance in Chicago?

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Calling All Chicago Renters!

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented apartment or space, renters insurance can be the most sensible step to protect your personal items, including your clothing, tablet, microwave, laptop, and more.

Looking for renters insurance in Chicago?

Your belongings say p-lease and thank you to renters insurance

Safeguard Your Personal Assets

Renting a home makes the most sense for a lot of people, and so is getting insurance to protect your belongings. In general, your landlord's insurance may cover damage to the structure of your rented home, but that doesn't include what you own. Renters insurance helps guard your personal possessions in case of the unexpected.

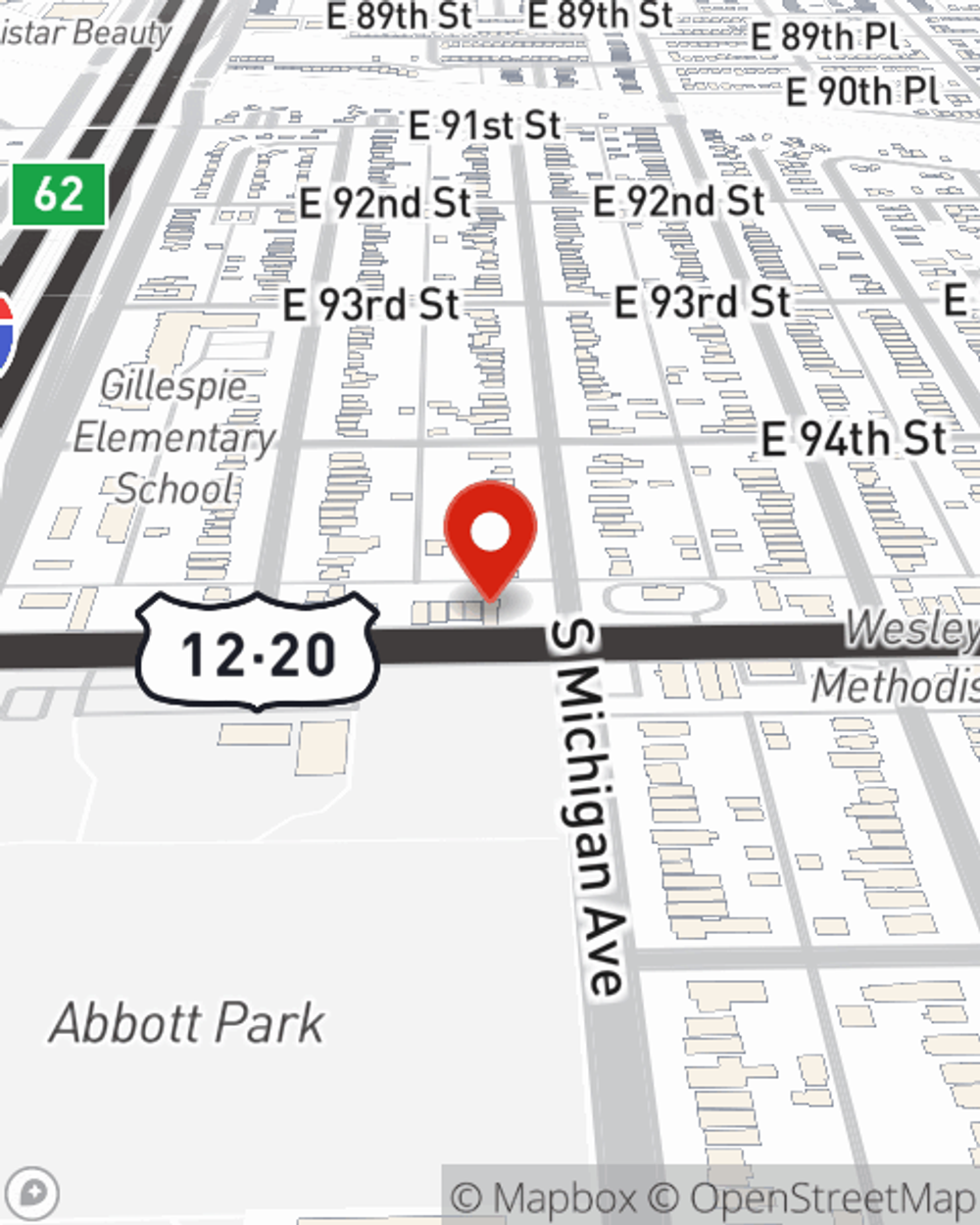

There's no better time than the present! Contact Camille Garrett's office today to get started on building a policy that works for you.

Have More Questions About Renters Insurance?

Call Camille at (773) 264-8300 or visit our FAQ page.

Simple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Camille Garrett

State Farm® Insurance AgentSimple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.