Condo Insurance in and around Chicago

Here's why you need condo unitowners insurance

Insure your condo with State Farm today

Welcome Home, Condo Owners

As with any home, it's a good plan to make sure you have coverage for your condominium. State Farm's Condo Unitowners Insurance has outstanding coverage options to fit your needs.

Here's why you need condo unitowners insurance

Insure your condo with State Farm today

Safeguard Your Greatest Asset

Your home is more than just a structure. It's a refuge for you and your loved ones, full of your personal items with both sentimental and monetary value. It’s all the memories made in your family room and around the kitchen table. Doing what you can to help keep it safe just makes sense! That's why one of the most sensible steps is getting a Condominium Unitowners policy from State Farm. This protection helps cover a wide range of home-related problems. For example, what if a fire damages your unit or someone vandalizes your property? Despite the emotional turmoil or frustration from the experience, you'll at least have some comfort knowing your State Farm Condominium Unitowners policy that may help. You can work with Agent Camille Garrett who can help you file a claim to help assist replacing your lost items. Preparing doesn’t stop troubles from knocking at your door. Coverage from State Farm can help get your condo back to its sweet spot.

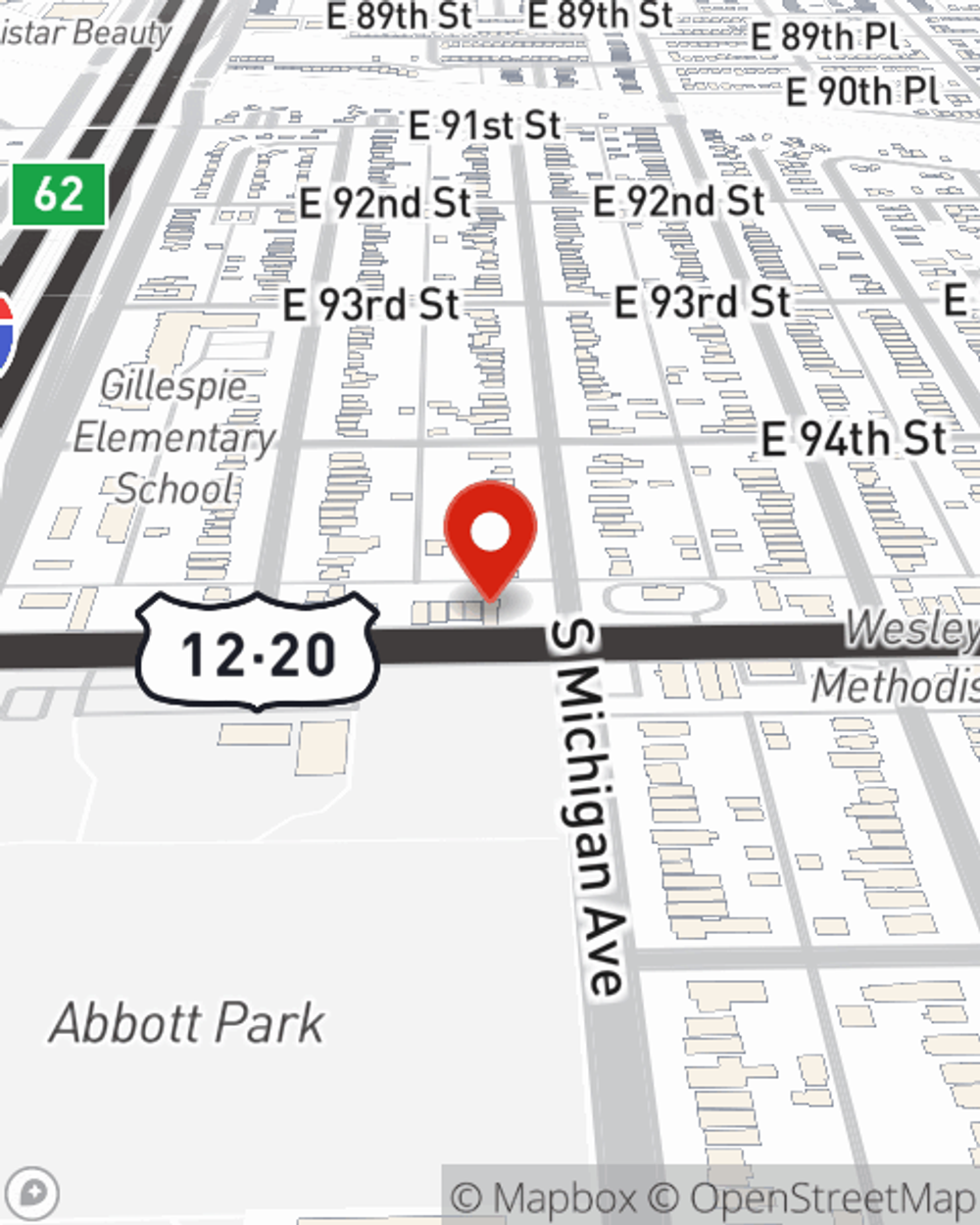

Chicago condo owners, are you ready to find out what a State Farm policy can do for you? Call or email State Farm Agent Camille Garrett today.

Have More Questions About Condo Unitowners Insurance?

Call Camille at (773) 264-8300 or visit our FAQ page.

Simple Insights®

What is individual liability insurance and what does it cover?

What is individual liability insurance and what does it cover?

Liability insurance is typically a portion of the coverage for a home or vehicle policy. A Personal Liability Umbrella Policy may be another viable option for further protection.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.

Camille Garrett

State Farm® Insurance AgentSimple Insights®

What is individual liability insurance and what does it cover?

What is individual liability insurance and what does it cover?

Liability insurance is typically a portion of the coverage for a home or vehicle policy. A Personal Liability Umbrella Policy may be another viable option for further protection.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.